On August 1, 2024, a huge fire was reported in Korea involving nearly 900 burned and damaged vehicles, which initiated from a parked EV. Since then, there has been a sharp increase in news reports in Korea of fires involving electric vehicles and ESS equipped with secondary batteries. Given that batteries with high-energy output and capacity are increasingly required to meet customer preferences for long range and high performance EVs, the fire safety of secondary batteries has become a major issue in Korea, and there is an increasing focus on safety technology to detect and/or prevent secondary battery fires.

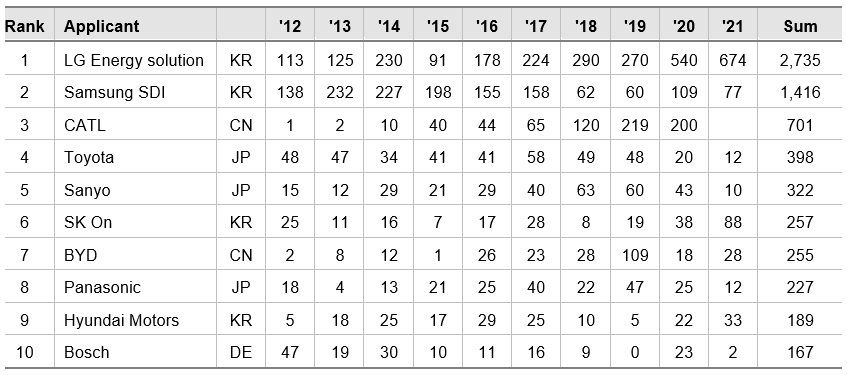

In connection with this, last November, the Korean Intellectual Property Office (KIPO) announced the results of its analysis of global patent application statistics relating to battery fire safety technology over the past 10 years (from 2012 to 2021). The results indicate that patent applications relating to battery fire safety technology grew by an average of 15% per year over the past 10 years (715 to 13,599). Out of 13,559 patent applications, the highest proportion were filed by applicants with Korean nationality at 37.7% (5,122), followed by China (22.8%, 3,099), Japan (21.0%, 2,855) and the US (11.2%, 1,518). The list of top 10 individual filers is as follows:

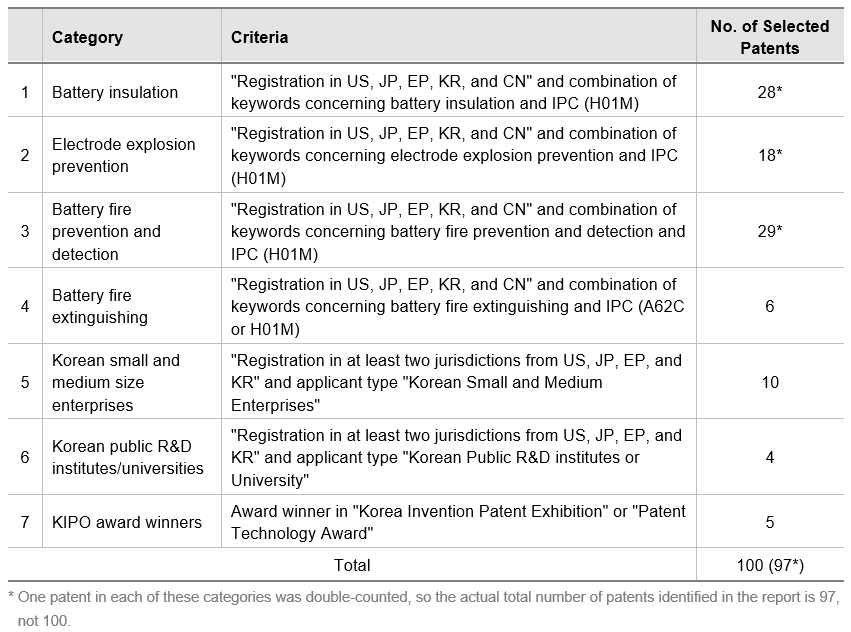

Around the same time, KIPO also issued a report entitled "100 Selected Patents on Battery Fire Safety Technology," which purports to identify 100 registered Korean patents (from any applicant nationality) filed during the last 20 years (from '03 to '23), based on the following criteria.

More than half of the patents selected are in the "battery insulation" and "battery fire prevention and detection" categories. Similar to the patent statistics discussed previously, the two Korean battery giants LG Energy Solution and Samsung SDI are the dominant filers in those categories, with LG Energy Solution owning 11 of the 27 patents in the battery insulation category, and Samsung SDI owning 11 of the 28 patents in the battery fire prevention and detection category.

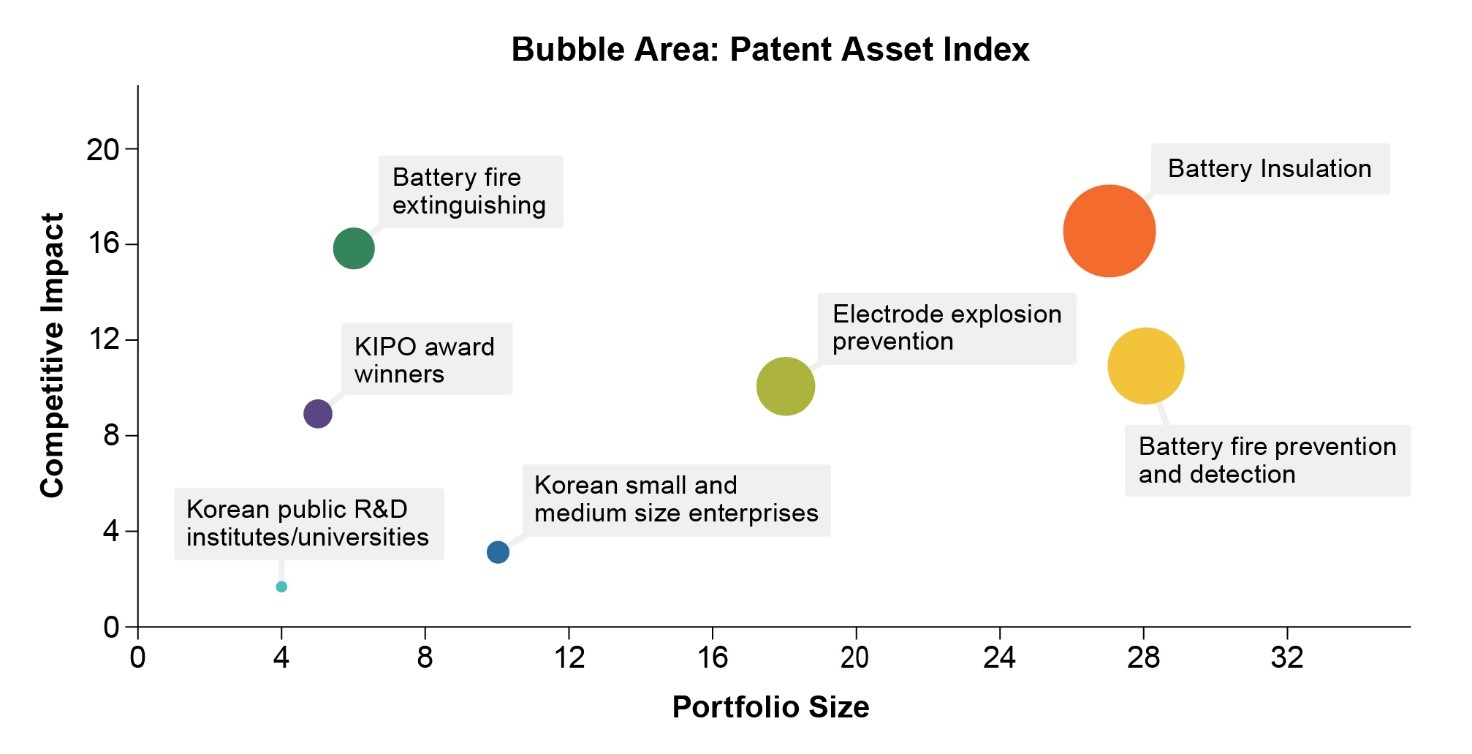

In order to numerically evaluate the selected patents, we analyzed information relating to these patents with the PatentSight+TM tool. Our analysis indicated that patents in the "battery insulation" and "battery fire extinguishing" categories had the highest qualitative value (represented by their Competitive Impact scores, Y-axis value in below graph), followed by the "battery fire prevention and detection," "electrode explosion prevention," and "KIPO Award winner" categories. When considered together with portfolio size, the "battery insulation" category seems to be the one receiving the most attention from patentees. This makes sense given that "battery insulation" technology is not only important for safety as a result of preventing fire or thermal propagation to adjacent cells and components, but also for maintaining the efficiency of battery cells in cold weather. As EV batteries are moving to using CTP (Cell-to-Pack) or CTC (Cell-to-Chassis) technologies and/or LFP (Lithium Ferro-Phosphate, aka lithium ion phosphate) technology, which all have relatively poor low-temperature characteristics, the importance of improved battery insulation becomes obvious.

Patents in the "Korean small and medium size enterprises" and "Public R&D institutes/universities" categories, on the other hand, appear to have relatively low value. From our quick review of the patents in these categories, they largely relate to very specific technologies (i.e., with limited application), or to early stage technologies needing substantially more development.

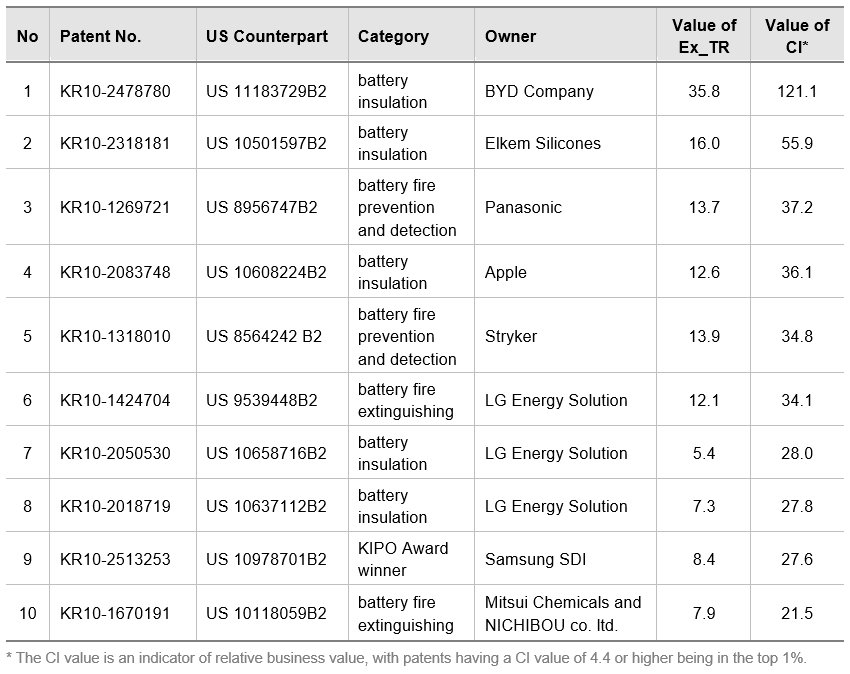

Of the 97 patents selected by KIPO, the top 10 with the highest value are listed below. These patents appear to be technologies frequently referenced in the industry, as they have a high level of external technology relevance (Ex_TR), which is an index of technological relevance calculated based on citation indices other than those of the applicant/patentee.

It is interesting that companies that do not primarily focus on batteries, such as Apple (consumer electronics technology company) and Stryker (medical device manufacturing company), seem to have high quality patents in battery field, although the top 10 patentees are primarily battery companies such as BYD, Panasonic, LG Energy Solution and Samsung SDI, or material science companies such as Elkem Silicones and Mitsui Chemicals. We also note that Boeing (with its affiliates) and Obrist Technology GmbH each own 2 out of the 97 patents selected by KIPO. Therefore, in a business model where a company simply purchases batteries from a battery company and installs them in its own product, even if there are guarantees from the battery company regarding the risk of infringement as to the battery itself, prior review of patents related to fire safety will be necessary to fully address any infringement risk.

Related Topics