All-solid-state batteries ("SSB") are widely expected to become the predominant next-generation power source for electric vehicles. Recently, the Japanese financial newspaper Nikkei (here) reported that Japanese filers represent by far the largest share of patents for SSB technologies filed worldwide, including companies such as Toyota, Panasonic and Idemitsu Kosan, while leading South Korean companies in the automotive battery space such as Samsung Electronics, LG Chem (including LG Energy Solution [LG Ensol]) and Hyundai Motors are some distance behind in terms of the number of filings for these technologies, based on patent analysis by Patent Result Co. Ltd.

The report noted that while Toyota, the undisputed leader in filings, holds numerous patents covering a wide range of fields (everything from structures and materials to manufacturing processes), Korean companies have been ramping up their patent filings significantly since 2016, and in particular possess many patents that directly relate to real-world performance, such as the life span of batteries.

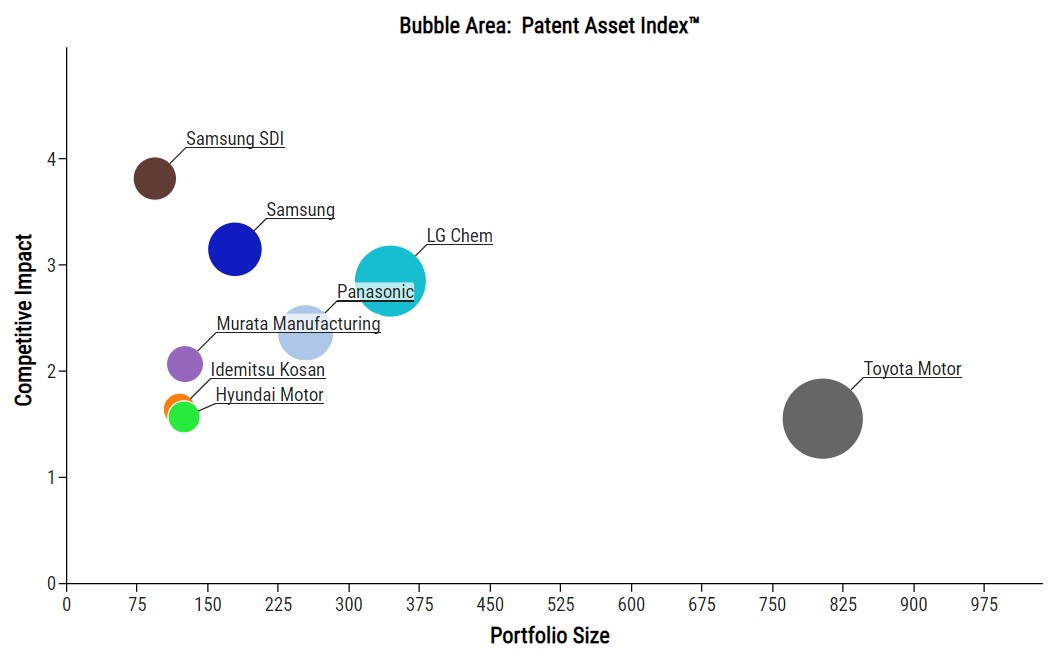

Although the portfolios of Samsung and LG Ensol are smaller in number than those of Japanese companies such as Toyota and Panasonic, the values of their patent portfolios according to the Competitive Impact™ or Patent Asset Index™ metrics provided by PatentSight® are comparable or greater, as the figure below shows. The Competitive Impact™ (axis Y) estimates the average value of individual patents in a portfolio. The Patent Asset Index™ (bubble area) is the sum of the Competitive Impacts of all patents in a portfolio, and conveys the innovative strength of the company's portfolio. Thus, despite the fact that Samsung and LG Ensol appear to have significantly fewer patents in the SSB space compared to Japanese competitors, individually their patents appear to be more valuable and higher quality.

Patent portfolio of major Japanese and Korean companies in SSB field (based on Kim & Chang's own patent analysis)

The situation with SSB patent filings appears to be very similar to the situation with lithium ion secondary battery patent filings in the mid-2010s, when Korea took over the lead for such filings from Japan. Thus, a brief review of the current status of development of SSB technology by Korean companies may be helpful for gaining insight into the future direction of this market.

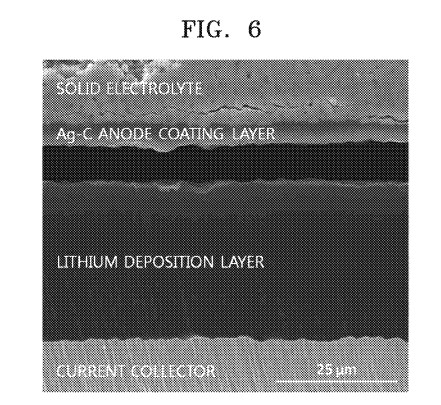

Samsung (in particular Samsung SDI) seems to be the most advanced of the major Korean companies with respect to SSB development, given that they recently started construction of an SSB pilot line on May 14, 2022. Looking at Samsung SDI's recent announcements in the "Battery Day 2022" seminar put on by the Electronic Times (a Korean newspaper, here) as well as their patent information, they seem to be focused on developing an SSB based on an ultrathin Ag-C composite in a lithium metal anodeless structure using a sulfide-type solid electrolyte. (See Fig. 6 of Samsung SDI's US Patent No. 11349114 B2 below)

LG Ensol has taken a different approach, choosing to develop polymer/sulfide-type electrolytes. According to an April 14, 2022 article in Business Korea (here), a company official at a seminar in Seoul on April 13 said that LG Ensol plans to set up an R&D base in Germany sometime this year, in order to accelerate the development of SSB. The company apparently aims to commercialize polymer-based SSB by 2026, and sulfide-based SSB (which requires more advanced technology compared to polymer-based batteries) by 2030.

Hyundai Motors announced its own project to develop solid state batteries in its first quarter conference call held in April 2021, indicating that they aim to produce a prototype in 2025 and to begin mass production in 2030. Interestingly, while Hyundai Motors is expanding their R&D structures for SSB, they also seem to have partnered with Factorial Energy based in the US, who are already developing their own solid-state tech.

It is difficult to predict at present which companies might become the leaders in the global SSB market, given that the technology is still in flux and we are still years away from commercial production. However, given that the wars over the lithium-ion battery market seem to have largely been settled, and that battery companies all over the world are investing heavily in research and development of SSBs, the competition to dominate the SSB market is sure to be fierce.

Related Topics